Private Equity

Access a diversified range of private equity opportunities from a market leader and industry pioneer

WHY PRIVATE EQUITY?

Private equity is no longer an alternative, it is a mainstream component of portfolios today

Private equity plays a significant role in the investment strategies of many of the world’s largest institutions. Investor qualification requirements, high minimums and lack of liquidity have historically made it difficult for a broader range of investors to access the asset class. This situation is changing, however, with the launch of new private equity vehicles tailored to the needs of eligible individuals.

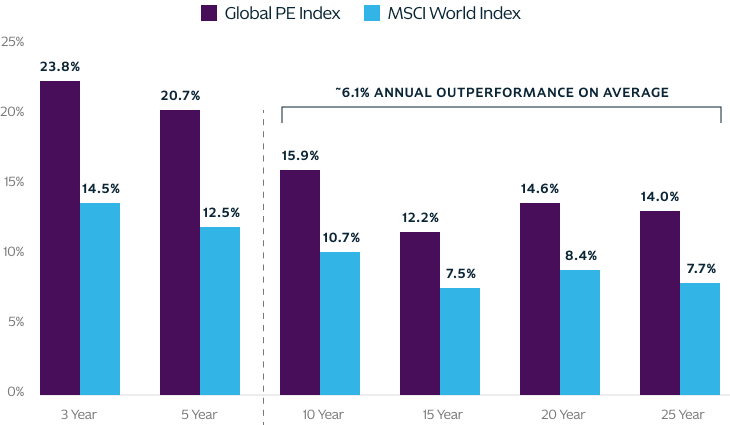

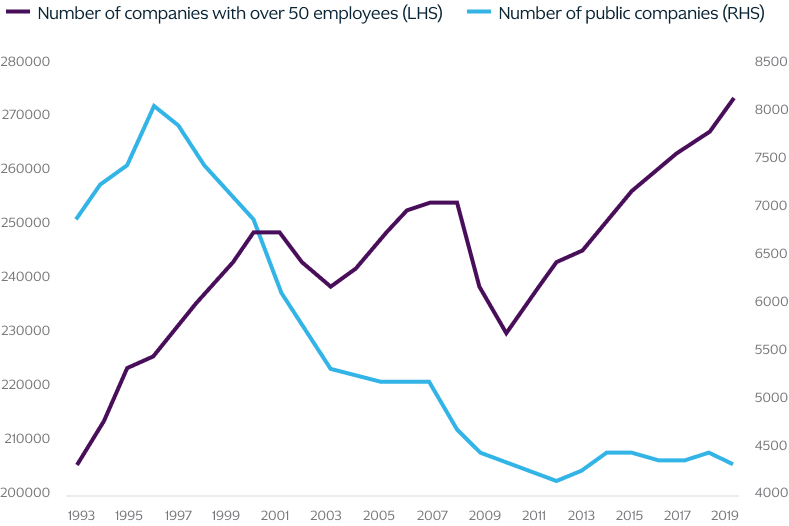

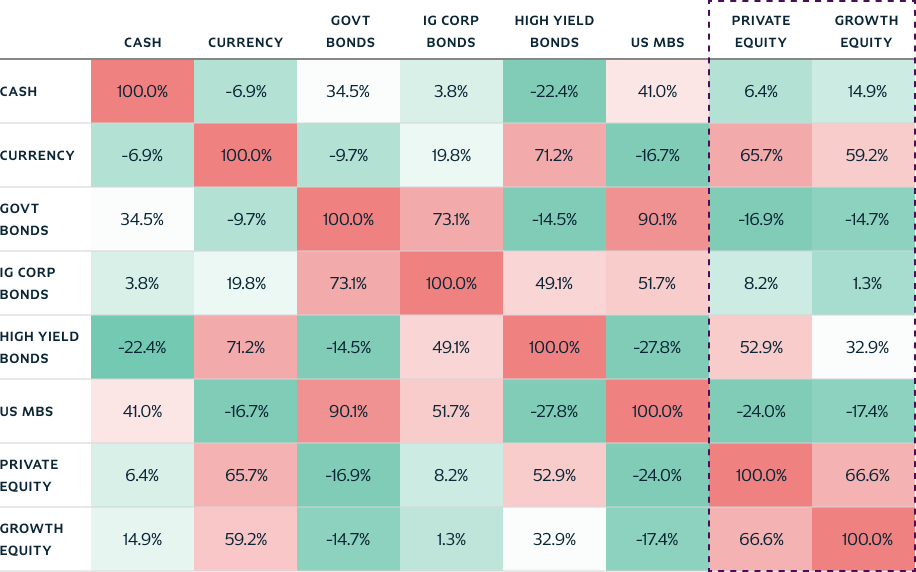

In the current environment, when stocks and bonds are increasingly moving in tandem, we believe private equity can serve as an important source of differentiated returns and diversification benefits. Private equity managers seek to create value by playing an active role in shaping the strategic direction and management of businesses.

Reasons to Consider Private Equity

1. Source: Cambridge Associates LLC Benchmark Statistics. As of June 30, 2022. Comparing Global PE Index and MSCI World Index. Data reflects actual pooled horizon return, net of fees, expenses and carried interest. For funds formed between 1986-2021.

WHY KKR?

Invest Alongside an Established Private Equity Partner

In 1976, KKR established itself as a pioneer of an entirely new asset class – private equity. Founded with just $120,000, KKR became a leading firm in what grew to a multi-trillion dollar industry today.

At KKR, we seek to generate attractive returns across our private equity strategies by leveraging our one-firm culture and the collective expertise of our accomplished investment professionals, operational experts and support specialists to step change the businesses we invest in and create value for our clients.

A MARKET LEADER

$183B

in private equity assets under management1

AN INDUSTRY PIONEER

48+

year history of private equity investing

ALIGNMENT OF INTEREST

$25B

of firm and employee capital committed to our own products2

GLOBAL REACH

26

offices on 4 continents

KEEP ME POSTED

Contact Us

Explore Other Private Market Asset Classes

Infrastructure

Access to private infrastructure assets that deliver essential services to communities and provide potential benefits to investors including consistent yield, a measure of inflation protection and value creation opportunities

Real Estate

Private real estate equity and credit strategies with the potential to deliver income, long-term growth, a measure of inflation protection and returns less correlated to public markets

Credit

Income-producing investment solutions across corporate direct lending, asset-based finance and publicly traded credit